Rumored Buzz on $100 Loan Instant App

Wiki Article

All about $100 Loan Instant App

Table of ContentsRumored Buzz on $100 Loan Instant AppLoan Apps for DummiesThe Basic Principles Of $100 Loan Instant App Best Personal Loans Things To Know Before You BuyWhat Does Loan Apps Do?Indicators on Best Personal Loans You Should Know

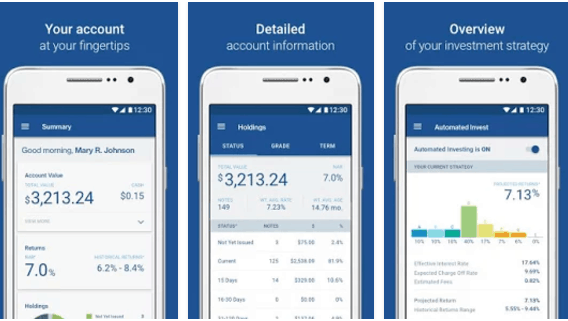

When we think regarding making an application for lendings, the imagery that enters your mind is individuals aligning in lines, waiting on numerous follow-ups, and obtaining entirely annoyed. But technology, as we understand it, has actually altered the face of the financing company. In today's economic situation, consumers and also not loan providers hold the trick.Financing authorization and documents to loan handling, every little thing is online. The several trusted online financing applications offer debtors a system to get car loans easily and also give authorization in minutes. You can take an from several of the most effective cash lending applications available for download on Google Play Shop as well as App Shop.

You simply need to download and install the application or go to the Pay, Sense internet site, sign up, post the called for records, and your loan will get approved. You will get alerted when your funding request is processed. Typically car loan application utilized to take a minimum of a couple of days. Sometimes, the financing authorization used to get stretched to over a month.

The Single Strategy To Use For Loan Apps

Usually, even after obtaining your finance approved, the process of obtaining the car loan quantity moved to you can take some time and get made complex. Yet that is not the case with online lending apps that provide a direct transfer alternative. Instant finance applications provide instantaneous personal loans in the variety of Rs.

You can avail of an immediate financing as per your qualification as well as need from instant loan apps. You do not have to fret the following time you want to make use of a small-ticket loan as you recognize how beneficial it is to take a finance utilizing on-line finance apps.

The Facts About Best Personal Loans Revealed

By digitizing and also automating the borrowing process, the system is changing conventional financial institutions right into electronic lending institutions. In this post, let's check out the advantages that a digital loaning system can bring to the table: what's in it for both banks and also their customers, and how digital loaning systems are interrupting the sector.They can even scan the financial institution statements for info within just secs. These attributes help to guarantee a quick as well as practical customer experience. The electronic financial landscape is currently more dynamic than ever before. Every bank now desires everything, including loans, to be processed instantaneously in real-time. Consumers are no longer ready to await days - as well Visit Website as to leave their homes - for a loan.

The Facts About Instant Loan Uncovered

All of their everyday activities, including economic purchases for all their tasks as well as they favor doing their economic deals on it as well. They want the benefit of making transactions or using for a financing anytime from anywhere - best personal loans.In this instance, electronic borrowing platforms act as a one-stop solution with little hand-operated information input as well as rapid turnaround time from funding application to money in the account. Customers ought to have the ability to move effortlessly from one gadget to one more to complete the application forms, be it the internet as well as mobile interfaces.

Companies of digital financing platforms are called for to make their products in compliance with these laws as well as assist the loan providers concentrate on their business just. Lenders also has to see to it that the service providers are updated with all the most recent standards released by the Regulatory authorities to rapidly read the article incorporate them right into the electronic loaning platform.

Some Known Incorrect Statements About $100 Loan Instant App

The conventional manual financing system was a discomfort for both lending institution as well as customer. Clients had to make several trips to the financial institutions as well as submit all kinds of records, and by hand fill up out numerous kinds. instant loan.The Digital Borrowing system has altered the means financial institutions consider as well as implement their car loan purchase. Banks can now deploy a fully-digital finance cycle leveraging the current innovations. A terrific digital lending platform must have easy application entry, quick authorizations, certified borrowing procedures, and the capability to constantly enhance process efficiency.

Customers will certainly need to resort to non-bank resources of financing." It is necessary to their explanation keep in mind that lending is an extremely lucrative fintech market, where 28% of the leading 50 fintech business operate. So if you're considering entering into lending, these are reassuring numbers without a doubt. At its core, fintech is everything about making traditional economic processes quicker and also extra reliable.

$100 Loan Instant App - An Overview

One of the typical mistaken beliefs is that fintech applications only benefit economic organizations. The application of fintech is now spilling from financial institutions as well as lenders to little businesses. $100 loan instant app., Chief executive officer of the settlement platform Veem, sums it ideal: "Small companies are looking to contract out complexity to somebody else since they have enough to fret about.As you can see, the convenience of use covers the listing, revealing how ease of access and also ease given by fintech systems stand for a massive driver for client loyalty. You can use lots of fintech innovations to drive client depend on and retention for organizations.

Report this wiki page